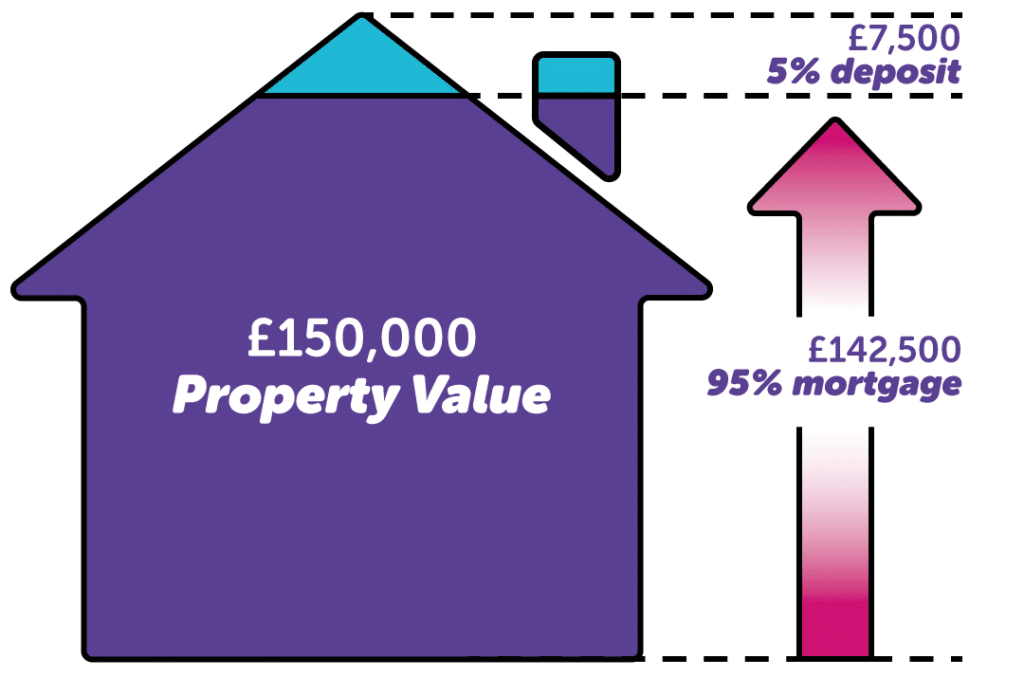

A 95% mortgage is what it says on the tin; you are borrowing against 95% of a property’s price, covering the remaining 5% with your deposit. An example of this is if you looked at buying a property worth £150,000 with a 95% mortgage, you would put down £7,500 as your deposit and borrow the remaining £142,500.

95% Mortgage Advice in Hull

With the March 2021 Budget, Boris Johnson announced a Mortgage Guarantee Scheme for Lenders, making 95% mortgages more readily available from the big banks.

This is great news for both first-time buyers and home movers as this will run until December 2022. Certain terms and conditions will apply, your Mortgage Advisor in Hull will be able to see if you qualify.

All our customers receive a free, no-obligation mortgage consultation where we will be able to recommend the best mortgage deal based on your individual situation.

Can I get a 95% mortgage?

95% mortgages are generally available to both first time buyers in Hull & people who are looking at moving home in Hull. Whilst the idea of saving for a 5% deposit sounds easy enough, you’ll still need to have a sufficient credit score and prove that you can afford your monthly mortgage repayments, in order to be granted a 95% mortgage.

Improving your credit score

A good credit score is the key to obtaining any mortgage, especially a 95% mortgage. Things like paying any existing credit commitments on time, ensuring your addresses are up-to-date and that you’re on the voter’s roll, can all help build this up. For a more in-depth look at what you can do and why, please see our how to improve your credit score in Hull article.

Affordability

Affordability is another one that is key. By providing details of your income and monthly outgoings (things like your bank statements will be necessary for this) and any pre-existing credit commitments, your lender will get a good idea of whether or not you are able to afford this type of mortgage.

Can my family help me get a 95% mortgage?

It’s very popular these days for family members to help each other get onto the property ladder, especially parents looking to further their children. This can be achieved by gifting the person looking to find their home, the deposit required for the property. Known by some as the “Bank of Mum & Dad, Gifted Deposits work purely as a gift, and not as a loan. The lender will need proof that this is the case, before it can be used towards your mortgage.

How do I choose the right 95% mortgage?

When looking for a 95% mortgage, you want to make sure you’re on the right one. Each different mortgage type works in its own unique way, allowing you to find one that is best suited for your personal and financial situation.

You could find that you prefer Fixed Rate or Tracker Mortgages, wherein you either keep interest rates at a set amount for the term or have your interest rates follow the Bank of England base rates.

Alternatively, you might find that you’re better suited for an Interest-Only or a Repayment Mortgage. The former of which allows cheaper payments until you need to pay a lump sum at the end (more suitable for Buy-to-Lets) and the latter of which means you’ll be paying interest and capital combined per month.

You can read more about these in our different types of mortgages in Hull article, with accompanying videos.

How can a bigger deposit help with my mortgage?

As with anything involving such a large financial outgoing, you need to be prepared and need to be wary. Things that might crop up, include higher interest rates, remortgaging difficulties due to less equity and then negative equity.

The good news here is that all these can be avoided if you’re savvy enough with your initial process. The more deposit you put down, the less risk you are to the lender.

A larger deposit, of say 10-15%, would not only lower your interest rate significantly but would also put more equity in the property and reduce the risk of negative equity as you would be borrowing less against the property in question.

So, whilst the risks seem daunting at first, planning ahead and saving for a bigger deposit to access something like a 90% or even an 85% mortgage will be a definite lifeline and something you’ll be able to reap the rewards from.

Date Last Edited: 09/28/2023